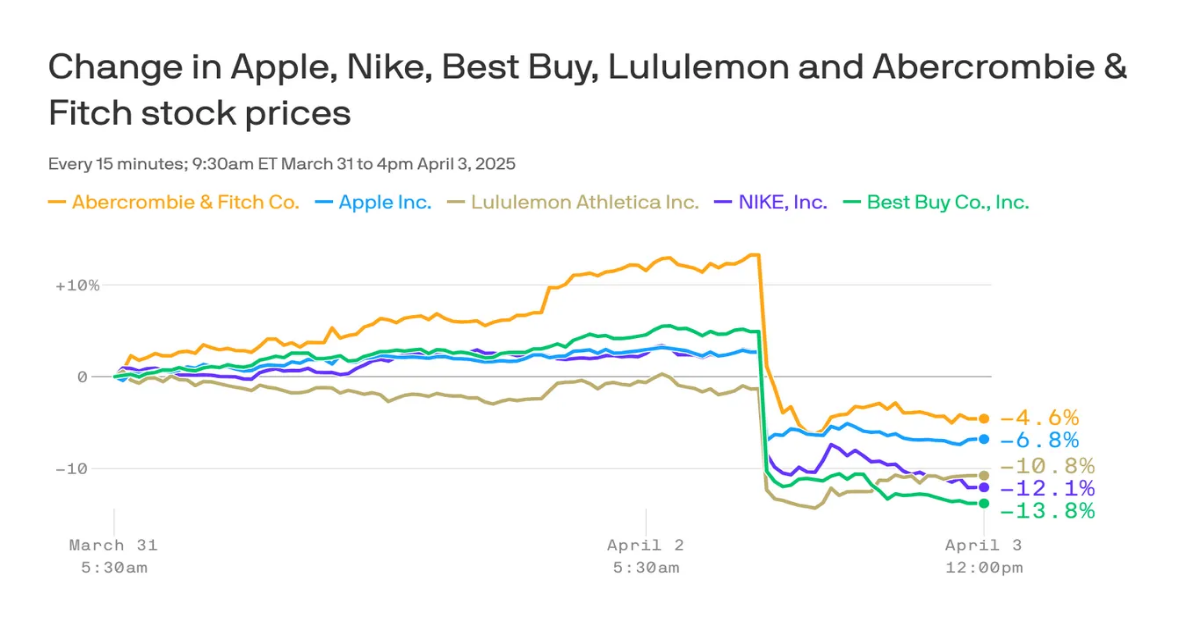

Data: Financial Modeling Prep; Chart: Axios Visuals

President Trump’s imposition of global tariffs is immediately pounding a slew of American businesses that depend on cheap international labor.

Why it matters: The tariffs were more severe than investors were anticipating — and stocks are consequently getting crushed.

Between the lines: The list of losers is long, including:

Nike: The apparel maker produces 28% of its Nike brand goods in Vietnam, 16% in China and 15% in Cambodia, according to an SEC filing.

- All three countries are getting hit hard by Trump’s new tariffs.

Other apparel companies: The Gap, Abercrombie & Fitch, Macy’s, Lululemon and Boot Barn experienced steep stock declines during trading.

Apple: The tech giant relies heavily on contract manufacturing from the likes of iPhone maker Foxconn in Asia, with “substantially all” of its production in China, India, Japan, South Korea, Taiwan and Vietnam, according to an SEC filing.

- It warned in November that tariffs could “increase the cost of the Company’s products and the components and raw materials that go into them, and can require the Company to take various actions, including changing suppliers, restructuring business relationships and operations, and ceasing to offer and distribute affected products, services and third-party applications to its customers.”

Best Buy: The electronics retailer gets about 55% of the products it sells from China and 20% from Mexico, according to an SEC filing.

- “Moreover, the consumer electronics we sell and our underlying technological infrastructure are dependent on rare earth elements, predominantly processed in China,” according to the company.

Luxury apparel and accessories companies: Fashion company Ralph Lauren, and Tapestry, maker of Coach and Kate Spade, were bloodied during trading Thursday.

Home goods makers: Shares of RH, formerly known as Restoration Hardware, and Williams-Sonoma were both under pressure.

- RH CEO Gary Friedman blurted out an expletive during an earnings call with analysts Wednesday afternoon when he saw what was happening to his stock, CNBC reported.

Automakers: Effectively all of the major automakers face a significant crisis from Trump’s tariffs.

- While some are less affected than others — Rivian makes all of its vehicles in the U.S., for example — not a single 2025 model-year vehicle sold in the U.S. gets more than 80% of its content from the U.S.

- Analysts project vehicle price increases of at least several thousand dollars, depending on the model.

- Volkswagen reportedly plans to impose an “import fee” to the price of vehicles exported to the U.S., while Bloomberg reported that Volvo and Mercedes-Benz are already exploring options to boost U.S. production.

The bottom line: It’s a bloodbath.

Editor’s note: This story has been updated with select closing levels.