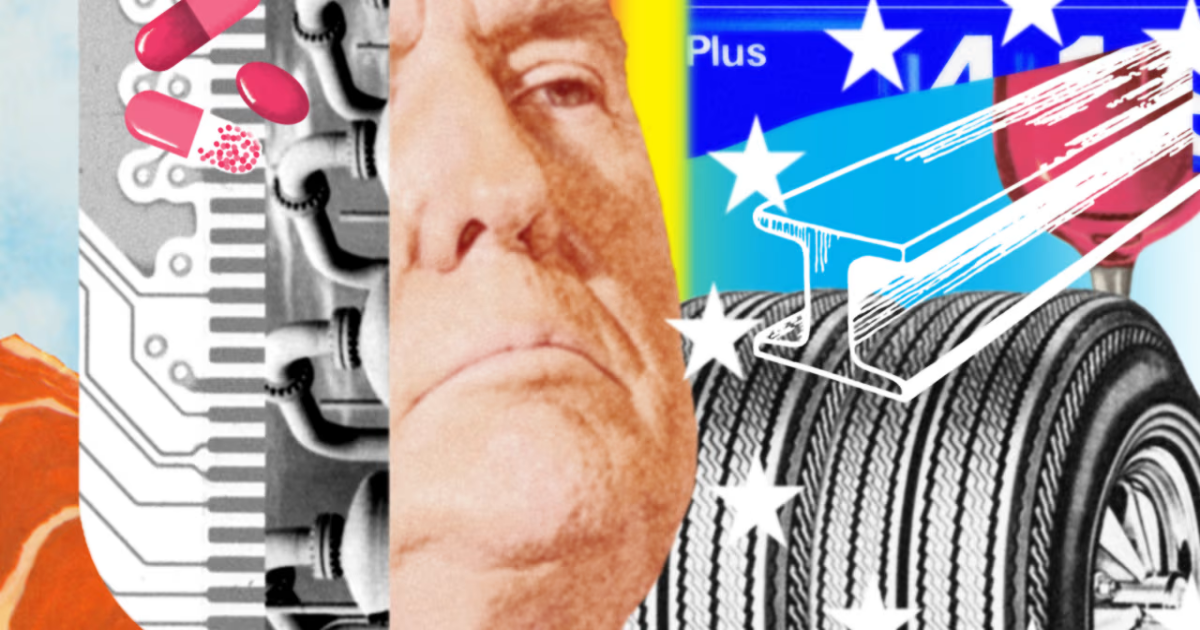

Investors took heart at signs the U.S. could strike deals with major trading partners, even after Beijing said it was prepared for a prolonged battle over tariffs.

Major U.S. indexes advanced more than 3% Tuesday morning, with the Dow industrials rising 1200 points. Treasury Secretary Scott Bessent said the Trump administration was open to negotiating to reduce tariffs, saying the U.S. could “end up with some good deals.”

Markets gyrated wildly Monday, driven in part by hopes for tariff resolution that turned out to be unfounded, before ultimately settling largely unchanged.

Meantime, Beijing lashed back at President Trump’s threat of even higher tariffs on China, raising the specter of an all-out trade war between the world’s two biggest economies. “If the U.S. insists on its own way, China will fight to the end,” the country’s Commerce Ministry said.

Trump said he will slap an extra 50% tariff on China if Beijing didn’t drop plans to retaliate against extra levies he announced last week.

In a sign Beijing is digging in for a protracted battle, the government threw its weight behind the stock market and devalued the yuan against the dollar, pulling a reference rate below a key threshold for the first time since the fall of 2023.

U.S. stock indexes surged. The S&P 500, Nasdaq Composite and Dow industrials all gained more than 3%.

Treasury yields rose above 4.25%. Ten-year yields settled Monday at 4.164%, after their sharpest one-day rise in a year.

The WSJ Dollar Index weakened.

Japan’s Nikkei 225 shot up 6%, after selling off Monday. Other Asian stocks mostly rose, as did European ones, led by the defense sector.

Indonesia’s stock market tumbled on reopening after a holiday that began before last week’s “Liberation Day.” Indonesia was one of several Southeast Asian economies Trump targeted with hefty levies.