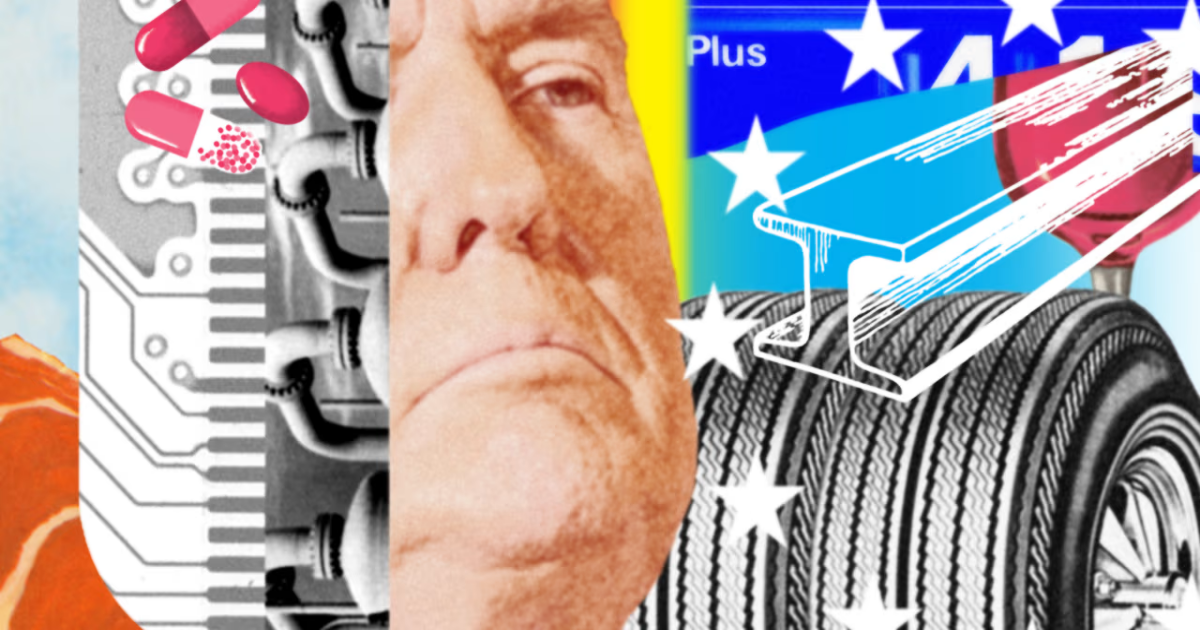

The trade war between the world’s largest economies spiraled further Friday, with China lifting tariffs on the U.S. to 125% and scoffing that further American levies would be seen around the globe as a “joke.”

Contracts tied to the Dow industrials, the S&P 500 and the tech-heavy Nasdaq 100 rose modestly in volatile trading. The Stoxx Europe 600 edged lower, while Japan’s Nikkei 225 index dropped 3% to close the week. The dollar extended its weeklong decline.

China’s decision marked the latest escalation in a tariff tit-for-tat that has grabbed global attention and rattled financial markets this month. Earlier, Canada’s Prime Minister Mark Carney said his government will counter “unjustified” U.S. levies of 25% on steel, aluminum and cars and inflict “maximum pain.”

The showdown has hammered U.S. assets, with major indexes falling 6%-7% since President Trump announced his tariff plan Wednesday afternoon. Gold has soared to fresh all-time highs, reflecting concerns about geopolitical conflict and the outlook for financial markets.

Some of the most intense action has shown up in foreign exchange. The U.S. dollar fell Friday for a fifth straight day, on track for its worst week since 2022. The euro was up as much as 2%, at a three-year high.

In part, the action reflects anxiety over the apparent instability of the global economic situation. On Friday, China said it wouldn’t continue to match any levy increases by the U.S.

“Even if the U.S. continues to impose higher tariffs, it would be economically meaningless and would become a joke in the history of the world economy,” Beijing said.

JPMorgan’s Jamie Dimon warned that the economy “is facing considerable turbulence,” as his bank reported quarterly results. Likewise, Larry Fink of BlackRock highlighted client “uncertainty and anxiety about markets and the economy,” drawing parallels with periods such as the financial crisis and the pandemic.

The partial suspension of U.S. tariffs “remains fragile” and the European Union must continue to prepare counter-measures to defend itself, French President Emmanuel Macron said earlier Friday.

European Union Trade Commissioner Maroš Šefčovič will meet with U.S. officials in Washington on Monday, an EU spokesman said.

U.S. stocks slid Thursday, accelerating declines after the White House said the tariffs imposed on China by Trump in his second term add up to 145%, not the 125% it previously indicated.

Wall Street likes JPMorgan’s earnings.

Wells Fargo profits rise.

Everyone is buying gold.

Tariff mania is rewriting the investing playbook.