The most popular Mexican restaurant chain in the U.S. is by far Taco Bell, with over 8,000 restaurant locations, followed by Chipotle with over 3,600 locations, according to ScrapeHero.

It’s no wonder that the Mexican restaurant sector is among the most dominant in the U.S., with 1 in 10 restaurants serving the cuisine and 99% of the U.S. population living in a county with a Mexican dining establishment, according to Pew Research Center data from 2024.

💸💰 Don’t miss the move: Subscribe to TheStreet’s free daily newsletter 💰💸

The prominence of Mexican restaurants in the U.S. has its drawbacks, as fierce dining competition can be detrimental to businesses when combined with economic challenges that all restaurants have been facing in recent years, such as rising inflation, increased interest rates on debt, and consumers’ changing attitudes toward dining out at restaurants.

Financial issues led several Mexican and Tex-Mex restaurants to file for Chapter 11 bankruptcy in the last year.

Tex-Mex chain Tijuana Flats Restaurants, which had as many as 123 locations, on April 19, 2024, filed for Chapter 11 bankruptcy, closed 11 of its locations, and sold the company to new owners after a strategic review that began in November 2023.

The Tijuana Flats bankruptcy was followed by Rubio’s Coastal Grill, which on June 5, 2024, filed for Chapter 11 bankruptcy to restructure its debt and closed 48 restaurants after a new California minimum wage law impacted the business.

On The Border Mexican Grill & Cantina files for Chapter 11 bankruptcy.

Shutterstock

On The Border files for bankruptcy

And now the parent company of popular Tex-Mex restaurant chain On The Border Mexican Grill & Cantina has filed for Chapter 11 bankruptcy with plans to sell its assets to its prepetition bridge loan lender, which is an affiliate of Pappas Restaurants.

OTB Holding LLC and six affiliates filed their petition on March 4 in the U.S. Bankruptcy Court for the Northern District of Georgia, listing $10 million to $50 million in assets and liabilities, which included over $19.6 million in funded debt.

More bankruptcy:

The company’s largest unsecured creditors include landlord Vereit, owed $2.9 million in rent; Bailey Lauerman and Associates Inc., owed over $1.66 million in trade debt; and The Wasserstrom Co., owed over $766,000 in trade debt, the petition said.

The debtor blamed a long list of problems that forced it to file for bankruptcy, including issues with liquidity, a negative macroeconomic environment, labor shortages, underperforming restaurants, creditor enforcement actions, inflation that led to higher menu prices, and changing consumer discretionary spending habits, according to a declaration by the company’s Chief Restructuring Officer Jonathan Tibus.

On The Border consists of about 80 locations, with 60 operated by OTB Holding, which is 100% owned by private equity firm Argonne Capital Group’s affiliate Borders Holdings, and 20 others run by franchisees. On The Border’s franchises pay 2.5% to 4% of sales as royalties to the parent company, which amounted to over $1.8 million in 2024.

The company had about 120 locations until it closed one-third of its locations in February.

The debtor closed or vacated 40 non-performing stores on Feb. 24 because of problems with rent and/or financial performance. The company began withholding vendor and rent payments, which led to vendors cutting services and withholding goods and landlords repossessing leased premises or exercising set-off rights.

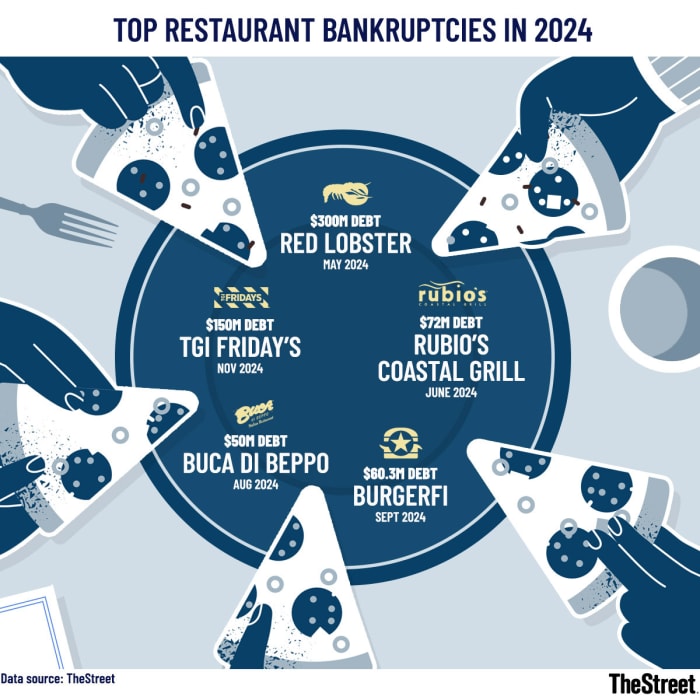

Top restaurant bankruptcies in 2024.

TheStreet

The company has 113 active leases, which include a significant number of non-operational locations. The debtor had $25.3 million in lease obligations in 2024, which included $11.8 million in leases on underperforming stores, according to the declaration.

The debtor filed for Chapter 11 bankruptcy to seek a sale of its assets to a stalking-horse bidder that’s an affiliate of Pappas Restaurants, who provided a $4 million prepetition bridge loan to the debtor.

The debtor is also seeking a $14 million DIP loan from the bridge lender, which consists of $7.5 million in new money on interim order approval, a roll-up of the $4 million bridge loan debt, and $2.5 million in new money on final order approval.

The debtor has not yet filed a bidding procedures motion with a proposed stalking-horse agreement as of March 5.

On The Border was founded in Dallas in 1982 and grew to 160 locations by 2010, when Brinker International sold the chain to Golden Gate Capital. It was sold again in 2014 to Border Holdings.

In 2020, Utz Group signed an agreement to manufacture and distribute On The Border chips and salsa for retail sales.