(Bloomberg) — A slump in the S&P 500 Index on Monday sent the Cboe Volatility Index a hair away from 30, the level it last reached during the volatility shock in August.

Most Read from Bloomberg

The VIX reached 29.56 shortly after 3 p.m. in New York before paring the advance as the S&P 500 plunged as much as 3.6%, with the VVIX, which measures volatility of VIX options, also spiking. The index of expected S&P 500 swings in the next month hasn’t spent much time above the 30 level since 2022, when stocks lost 19%. During the grind higher in equities over the past year and a half, the VIX just occasionally made it past 20.

The selloff accelerated after President Donald Trump on Sunday said the US economy faces “a period of transition,” while deflecting concerns about the risks of a slowdown.

There are very few put positions below 5,500 on the S&P 500, which may ease some of the stress, according to Brent Kochuba, founder of options platform SpotGamma.

“If we get into that area, the VIX would also potentially be 30-plus. But I don’t want to buy puts when the VIX is above 30 because it’s too expensive,” Kochuba said. “At least in the short-term, we’re getting so stretched to the downside and hedging flows get wiped out” with options expiration.

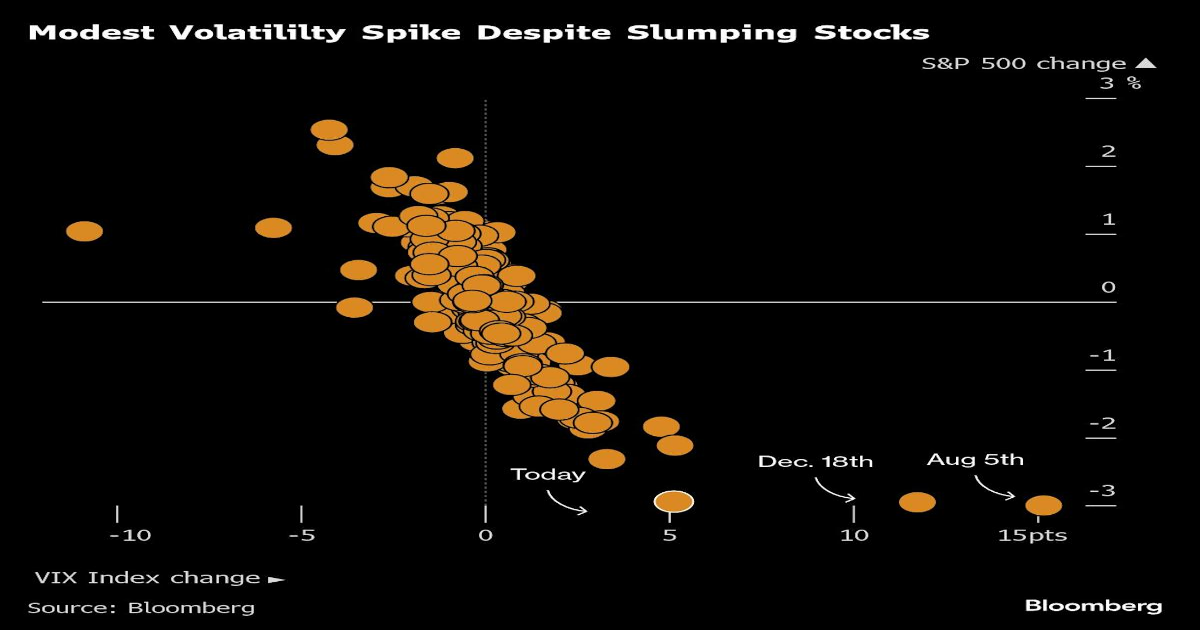

Still, the jump in the market’s “fear gauge” has been modest compared with similar S&P 500 drops back in August and December, with the selloff seen as more orderly than during the previous volatility shocks.

–With assistance from Jan-Patrick Barnert.

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.