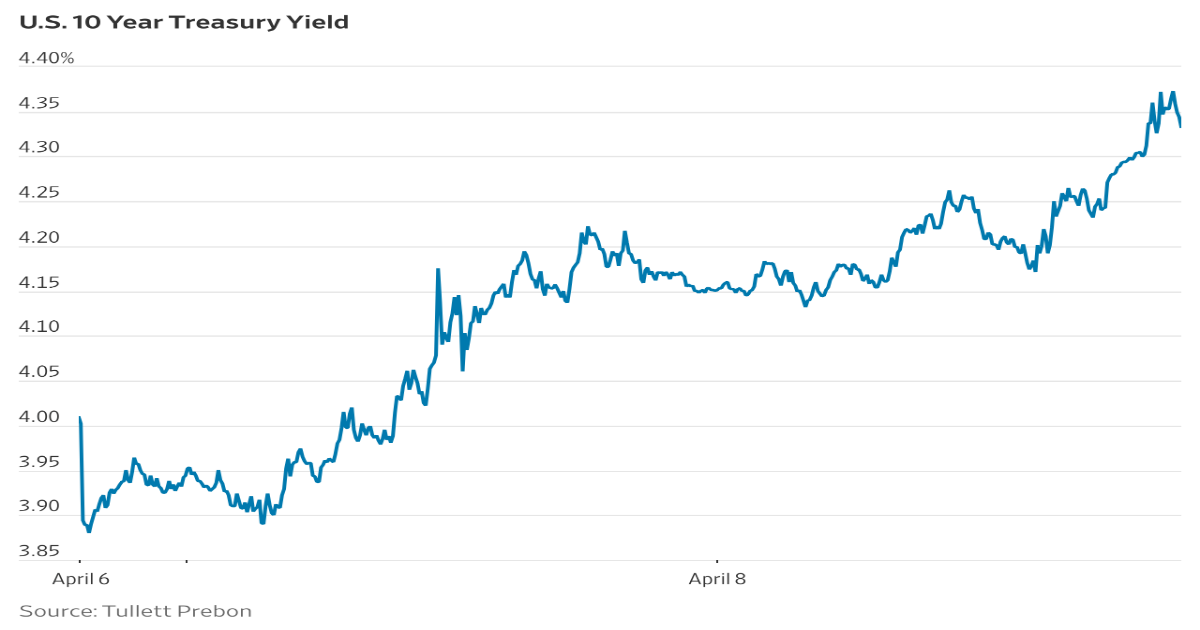

The sharp selloff in long-term Treasury bonds accelerated early Wednesday. The benchmark 10-year Treasury yield rose as high as 4.47% before retreating recently to 4.38%. It traded as low as 3.9% on Friday.

The bond selloff is alarming some investors, who are accustomed to seeing ultra-safe assets like Treasurys rally during times of stock-market or economic stress. Bond prices started falling Tuesday afternoon after a $58 billion auction of three-year notes met with weak demand.

Global bond yields have generally been rising in recent months, fueled by factors such as Germany’s decision to sell bonds to fund increased defense spending and political uncertainty in France. The Trump administration has signaled that it aims to bring down Treasury yields and energy prices in a bid to improve household financial conditions in the U.S., in part by presumably bringing down mortgage rates, but the selloff could complicate that effort.