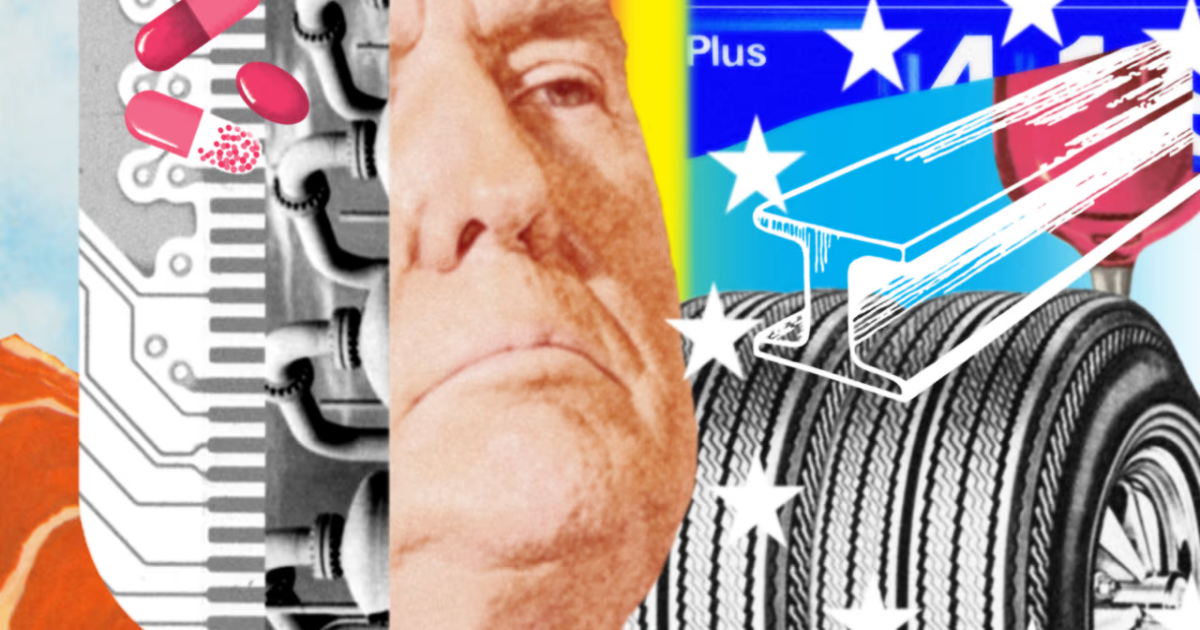

Coming next to the silver screen: the trade war.

On Sunday, President Trump said he had authorized a 100% tariff on films produced overseas, saying he was responding to tax incentives that have lured some productions abroad.

It wasn’t clear how such tariffs would work, but such a move would extend the trade war beyond physical goods—and also to an industry where the U.S. runs large surpluses.

Also over the weekend, Warren Buffett weighed in on tariffs, saying trade “should not be a weapon.” The 94-year-old investor was speaking at a Berkshire Hathaway shareholder meeting, where he told attendees he would step down as CEO by year-end.

Stock futures slipped Monday, indicating indexes could end a historic stretch of gains. The S&P 500 notched a nine-session winning streak Friday, its longest since 2004. Both that index and the Nasdaq Composite are now higher than they were before Trump’s April 2 tariff blitz.

A key event for markets this week is Federal Reserve’s interest-rate decision, due Wednesday. The Fed is widely expected to hold borrowing costs steady. Trump has repeatedly called on Fed Chair Jerome Powell to cut rates, including in the interview aired Sunday, but has backed off an earlier implied threat to fire him.

U.S. stock futures fell. Contracts tied to the S&P 500, Dow industrials and Nasdaq-100 each lost more than 0.5%.

The WSJ Dollar Index retreated, on track for a second straight decline. In Taipei, the Taiwanese central bank convened an emergency meeting and denied the U.S. had demanded Taiwan boost the value of its currency.

Oil prices declined, after the OPEC cartel and its allies agreed a further boost to output. Brent crude futures dropped to roughly $60 a barrel.

Gold futures climbed to nearly $3,275 a troy ounce. They had hit an all-time high above $3,500 last month.

Overseas, the Stoxx Europe 600 ticked lower. Markets in China, Japan, South Korea and the U.K. were closed.

Earnings: Palantir and Ford will report after the close.

PMIs: Purchasing managers indexes for services are due shortly after markets open.