7:40PM The latest comments from Donald Trump suggest India might be the first in line for a trade deal with the US.

Speaking to reporters outside the White House, the President said talks with India on tariffs were “coming along great”, adding that he thinks the two countries will reach a deal.

Trump also said he would plan to visit Africa. He said separately that he planned to speak with officials in Australia.

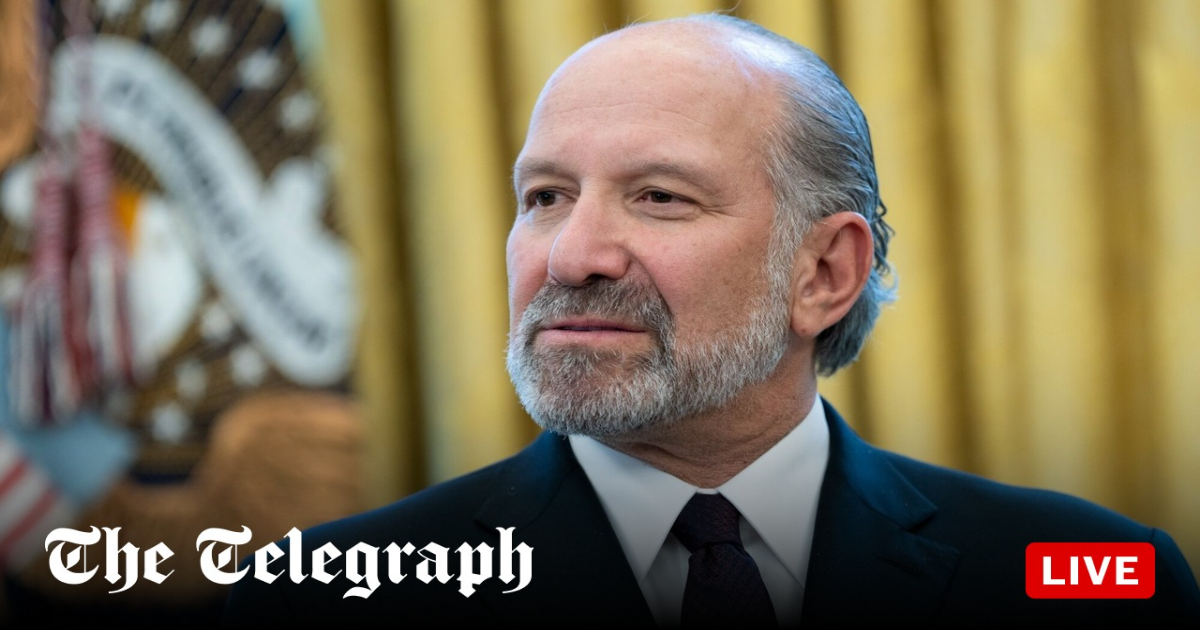

7:03PM Lutnick dismisses the market chaos in the wake of Trump’s tariffs, saying Wall Street doesn’t see the “big picture”.

But he also plays down the importance of financial markets.

“The President is just not focused on the markets. This term he’s trying to reset global trade,” he says.

“He’s going to protect the US economy. He’s going to be the greatest economic driver.”

6:57PM Howard Lutnick has said the US is going to “relentlessly” do trade deals around the world.

Asked about the row over Amazon’s reported plans to put tariff costs on receipts, the commerce secretary played down the impact of tariffs, suggesting they were simply a bargaining chip to secure trade agreements.

“What you’re going to see is us relentlessly do trade deals everywhere in the world,” he says. “This is how you get employment, this is how you get better lives. Donald Trump understands it… It’s going to be amazing.”

Lutnick goes on to claim that he’s already got a trade deal in place, but won’t give any details, saying it was still contingent on parliamentary approval in that country.

6:49PM The US commerce secretary Howard Lutnick is currently giving an interview on CNBC.

He’s arguing that Donald Trump’s tariffs are accelerating the construction of factories in the US, pointing to Taiwanese chip giant TSMC’s $100bn investment in new plants.

He said: “This is the point of the Trump tariff model, which is to bring advanced manufacturing to America.

“We need, for national security, to bring semiconductors home.”

6:03PM The US trade deficit in goods surged to a record high in March as businesses began stockpiling ahead of President Donald Trump’s sweeping tariffs.

The goods trade gap increased 9.6pc to $162.0bn, the highest on record, according to figures from the Commerce Department’s Census Bureau said.

Goods imports soared $16.3bn to an all-time high of $342.7bn, driven by a 27.5pc jump in imports of consumer goods. There were also solid increases in imports of automotive vehicles and capital goods.

But imports of industrial supplies, which had been boosted by non-monetary gold, declined 13.5pc. Food imports fell as did those of other goods.

The report prompted economists to sharply downgrade their GDP estimates for last quarter to show a steeper decline rather than growth just stalling.

Goldman Sachs now sees GDP contracting at a 0.8pc annualised rate while JPMorgan forecasts output declining at by 1.75pc.

5:35PM Shoppers are boycotting Coca-Cola amid a backlash over Donald Trump’s erratic foreign policy, Carlsberg has said.

The Danish brewer, which bottles the fizzy drink in its home country, said sales were “slightly down” as consumers protested against the US president.

Jacob Aarup-Andersen, the Carlsberg chief executive, said: “There is a level of consumer boycott around the US brands … and it’s the only market where we’re seeing that to a large extent.”

Mr Trump has ignited a global trade war and market chaos after slapping huge tariffs on scores of countries and industries.

He has sparked particular anger in Denmark after making repeated threats to seize control of Greenland, an autonomous Danish territory, either by buying the island or through military force.

4:47PM General Motors has become the latest major US company to feel the effects of Donald Trump’s tariffs.

In a highly unusual move, the car giant pulled its annual forecast, saying it wanted to wait before commenting on changes to tariff policy. The US President is expected to scale back his 25pc tariffs on the automotive sector later today.

Paul Jacobson, GM’s chief financial officer, said: “The future impact of tariffs could be significant. We’re telling folks not to rely on the prior guidance, and we’ll update when we have more information around tariffs.”

GM is also pausing its share buyback activity, pending more clarity on the economic situation. In February, it said it would repurchase $2bn of shares by the first half of this year.

Despite the uncertainty, the company’s revenues rose 2.3pc to $44bn in the first quarter, boosted by customers rushing to buy before prices rise.

4:28PM

Tensions have been boiling over between Amazon and the White House today. Daniel Woolfson and Chris Price have the latest:

The White House has accused Amazon of a “hostile and political act” as Jeff Bezos’s online shopping giant prepares to display the cost of Donald Trump’s tariffs within order receipts.

Amazon will split out the cost of tariffs within overall costs, allowing customers to see exactly how much the levies are adding to the price of goods, according to Punchbowl, a US political website.

The report provoked an immediate backlash from the Trump administration. Karoline Leavitt, the White House press secretary, told reporters: “This is a hostile and political act by Amazon. Why didn’t Amazon do this when the Biden administration hiked inflation to the highest level in 40 years?

“This is another reason why Americans should buy American. It is another reason why we are on-shoring critical supply chains here at home to shore up our own political supply chain and boost our own manufacturing here.”

4:14PM Kraft Heinz has cut its earnings forecast for the year, citing a volatile environment.

The maker of food staples, including its eponymous ketchup and baked beans, forecasts annual sales to decline 1.5-3.5pc, down from an earlier projection of 0-2.5pc.

Carlos Abrams-Rivera, the chief executive, said: “In today’s uncertain times, we are committed to controlling the controllables and making the necessary investments to deliver quality, taste, and value to our consumers through our beloved brands.

“We’re closely monitoring the potential impacts from macro-economic pressures such as tariffs and inflation.”

The packaged foods company has posted six straight declines in total revenue, as it faces being squeezed by both budget and premium labels.

3:49PM US consumer confidence has fallen to its lowest level since the onset of the Covid-19 pandemic, according to survey data published on Tuesday, reflecting concerns about Donald Trump’s tariff plans.

The Conference Board’s gauge of confidence fell nearly 8 points to 86 in April, the research organisation announced, noting that mentions of tariffs in write-in responses had reached an “all-time high.”

It marked the fifth straight monthly decline, the longest such stretch since 2008.

Stephanie Guichard, senior economist at The Conference Board, said: “The three expectation components – business conditions, employment prospects, and future income – all deteriorated sharply, reflecting pervasive pessimism about the future.”

3:27PM China was understood to have waived its tariffs on ethane imports from the US in an effort to ease pressure on its petrochemical industry.

The byproduct of US shale gas production is used as a feedstock in the production of ethylene, which is used to create plastics, antifreeze, and detergents.

Bejing granted a tariff exemption on the product in recent days, according to Reuters, weeks after Donald Trump exempted smartphones from his steep tariffs on China.

3:10PM The US economy added fewer job vacancies than expected last month as Donald Trump began to announce his tariff plans.

Job openings fell to 7.2m in March, compared to 7.5m the previous month, according to the US Bureau of Labor

Statistics. It was lower than the 7.5m forecast by analysts.

The Job Openings and Labor Turnover Summary, known as JOLTS, showed that the number of vacancies was down by 901,000 over the course of the year.

Analysts said the jobs market was impacted by the “damage tariffs will do”:

JOLTS charts:1/ It reflects a labor market that “could have been” given the damage tariffs will do, but hires, quits and layoffs were all stable in March.

(The stabilization of hiring actually began in late summer 2024.) pic.twitter.com/1xriQbUaNJ

— Guy Berger (@EconBerger) April 29, 2025

JOLTS job openings fell to 7192k in March, below expectations, while the ratio of job openings to those unemployed dropped to 1.0, matching its 4-year low. pic.twitter.com/DSkSOphugG

— Kathy Jones (@KathyJones) April 29, 2025

2:36PM The S&P 500 and the Nasdaq fell at the open as investors assessed a mixed bag of corporate earnings and the latest developments in the US-China trade war.

The S&P 500 fell 19.9 points, or 0.4pc, to 5,508.87, while the Nasdaq Composite dropped 95.4 points, or 0.6pc, to 17,270.76.

The Dow Jones Industrial Average was little changed at 40,233.98.

2:27PM Donald Trump plans to sign an executive order easing the impact of his car tariffs later today, the White House said.

Press secretary Karoline Leavitt said the administration would release the text of the directive, detailing the specifics of the action, later today.

President Trump will be in Michigan later today, the home of America’s biggest car manufacturers, where he will hold a rally to mark 100 days since he returned to office.

Treasury secretary Scott Bessent added: “President Trump has had meetings with both domestic and foreign auto producers, and he’s committed to bringing back auto production to the US.

“So we want to give the automakers a path to do that quickly, efficiently and create as many jobs as possible.”

2:21PM Scott Bessent said Donald Trump aimed to bring “precision manufacturing” back to the US as he prepares to alter his tariffs on the car industry.

The US treasury secretary said he would not give details on the relief due to be offered over car tariffs but said “it will go substantially toward reshoring American auto manufacturing”.

He said: “Again, the goal here is to bring back high-quality industrial jobs to the US.

“President Trump is interested in the jobs of the future, not the jobs of the past.

“We don’t need to necessarily have a booming textile industry like where I grew up again but we do want to have precision manufacturing and bring that back.”

He added: “Economic security is national security. National security is economic security and we saw during Covid that our supply chains got cut off and we need to bring back a lot of those supply chains, whether it’s in semi-conductors, medicines, steel.

“We have to onshore those so it’s a combination of making trade free and fair, and remedying this gaping national security hole that he was left with.”

2:05PM The White House accused Amazon of a “hostile and political act” over tariffs after the consumer goods giant said it would display the cost added to the price of goods from Donald Trump’s tariffs war.

“Why didn’t Amazon do this when the Biden administration hiked inflation to the highest level in 40 years?” asked White House press secretary Karoline Leavitt at a briefing with reporters.

She added the move was “not a surprise” as Amazon had partnered “with a Chinese propaganda arm”.

“This is another reason why Americans should buy American.

“It is another reason why we are on-shoring critical supply chains here at home to shore up our own political supply chain and boost our own manufacturing here.”

1:57PM Scott Bessent said there were “chances” of announcements soon on trade deals with India and South Korea with the US.

The treasury secretary said there had been “substantial talks” with Japan.

He said the US was “very close” to a deal with India, which was easier to negotiate with because it had several high and clear tariffs against the US.

He said it was tougher to deal with countries that had “very unfair trade deals put in over decades”.

1:53PM Scott Bessent said tariffs were “unsustainable” for China and would lead to job losses.

Asked whether President Trump had spoken to his counterpart Xi Jinping, he said that he was “not running the switchboard” at the White House.

The US treasury secretary told a White House press briefing that announcing trade deals with allies would “bring certainty”.

1:50PM Scott Bessent said the long-term goal of the US tariff campaign was a “combination of both” long-term revenue and to achieve better trade relationships.

The US treasury secretary told a White House press briefing there was a “good chance” that an upcoming tax bill would feature “income tax relief” as a result of the revenues accrued from tariffs.

1:46PM UPS said it plans to cut 20,000 positions worldwide this year following a significant drop in business for Amazon, its largest customer.

The package delivery giant expects to “reduce our operational workforce by approximately 20,000 positions during 2025 and close 73 leased and owned buildings by the end of June 2025,” the company said.

1:13PM General Motors reported a drop in profits in the first three months of the year as it re-examines its outlook for 2025 in light of uncertainty over US tariffs.

GM, which has been among the carmakers hardest hit by President Trump’s multiple tariff announcements, pushed back its earnings conference call to Thursday after The Wall Street Journal reported Monday night that the US would ease some levies on carmakers.

Profits were down 6.6pc to $2.8bn (£2.1bn), while revenues rose 2.3pc compared to the same period last year to $44bn.

Chief financial officer Paul Jacobson said the company was “reassessing” its projections from its January forecast, which made no attempt to incorporate tariff effects.

He said: “We believe the future impacts of tariffs could be significant.”

He added that the company was engaged in “productive conversations” with the Trump administration, which is pressing companies to build more cars in the United States.

Shares of GM fell 2.4pc in pre-market trading.

12:55PM The UK’s flagship stock index edged higher despite disappointing results from some of is major companies against the backdrop of global tariffs.

The FTSE 100 ticked up 0.3pc by lunchtime despite hits to the share prices of heavyweights like AstraZeneca, BP and Primark-owner Associated British Foods.

AstraZeneca, the most valuable company on the index with a market cap of £159bn, fell as much as 5.2pc after the pharmaceutical giant missed some analysts’ estimates for the first quarter amid concern over Donald Trump’s sabre-rattling over future pharmaceutical tariffs.

Pascal Soriot, the chief executive, warned that tariffs were not the best way to manage pharmaceuticals and that drugmakers were lobbying for no additional US levies on medicines.

The drugmaker also committed a $3.5bn investment for its US business by the end of 2026.

Oil giant BP tumbled 4.7pc after announcing its net profit had plunged in the first quarter, dented by the price of Brent crude slumping 12pc since the start of April to $65 a barrel.

Murray Auchincloss, the chief executive, said BP was a “little tighter than we were at $70” as he trimmed capital spending plans by $500m.

Helge Lund, the chairman, told shareholders: “Geopolitics and trade tensions are more complex today than for a long time. This uncertainty has had an impact on BP.”

Associated British Foods, which owns Primark, fell furthest with a 9.8pc drop after announcing a 10pc fall in first-half profit.

Keeping the index in the green, Howden Joinery enjoyed a jump of 7.4pc on the back of a positive trading update.

Betting giant Entain, which owns Ladbrokes and Coral, climbed as much as 7.6pc on the news that Stella David had been appointed permanent chief executive.

12:37PM Delta Air Lines may seek to avoid paying a 10pc tariff on the delivery of its latest wide-body jet from Airbus by routing the plane via Japan.The A350-900 aircraft is due to leave the European firm’s headquarters in Toulouse, France, on Wednesday and arrive in Tokyo the next day, according to two flight-tracking websites.The routing is believed to be part of a ploy by Delta to skirt Donald Trump’s import tariffs, which the carrier said this month it had no intention of paying.Delta used a similar strategy to avoid tariffs on a number of Airbus jets in 2019, amid a tit-for-tat spat between the US and European Union over state aid for planemakers.The approach is based around the fact that planes are no longer regarded as new once they have been flown on a mission that is not part of testing or a delivery flight.However, both the Fightradar24 and FlightAware websites later listed tomorrow’s A350 flight as cancelled, suggesting that Delta may have thought twice about the plan.Bloomberg reported that the airline had declined to comment on the routing. Airbus also declined to comment.

Delta CEO Ed Bastian said on April 9 that the airline would “not be paying tariffs on any aircraft deliveries” and would defer any to which levies applied. The Atlanta-based company has said it aims to take 10 new planes this year, all from Airbus.

The aviation industry is continuing to seek a carve out from President Trump’s tariffs during a 90-day pause on the introduction of a 20pc rate on products from the European Union.

The sector has been exempt from tariffs for decades under a 1979 international agreement, with the exception of the Airbus-Boeing aid row at the end of the last decade.

12:07PM The Bank of England is watching for warning signs that the dollar may lose its status as the global reserve currency, a top policymaker has said.

Sam Woods, head of the Prudential Regulation Authority at the Bank, said the US president’s “liberation day” tariffs have hit the reputation of American assets on the world stage.

He said the central bank is studying what would happen to Britain and the City of London if global investors turn their backs on the American currency amid Donald Trump’s trade war.

“This has created a bit of a dent, I think, in the way the US is seen both by regulators and investors. We’re asking ourselves the question, what would happen if there was a more fundamental drop in appetite for dollar-denominated assets, or US assets, or Treasuries, or some version of that,” he told the Treasury Select Committee.

“It is a difficult question to answer, but it is what we’re doing.”

The US dollar is fundamental to global financial markets, traditionally acting as the safe haven which international investors use when risks erupt in the wider economy.

But since the trade war kicked off, financiers have been ditching American assets, moving out of the dollar and away from US Government debt.

Mr Woods also said that Mr Trump’s actions have brought Britain and the EU closer together.

“We have had very good relations with our colleagues in the EU, but I can tell you that one byproduct of these events is that the warmth is increasing quite considerably, so that is actually a good thing,” he said.

“In the US we have had very strong cooperation for many years. I would expect that to continue, but… none of the three key heads of the agencies in the US have been confirmed, and until they are confirmed and we can engage properly, the jury is still a little bit out.”

Mr Woods noted that Scott Bessent, the US Treasury Secretary, appeared to cast doubt on the country’s commitment to the Basel rules which govern banking regulation in a speech last week, but told MPs he has since been reassured the US is not abandoning the internationally agreed rules.

12:07PM The Bank of England is watching for warning signs that the dollar may lose its status as the global reserve currency, a top policymaker has said.

Sam Woods, head of the Prudential Regulation Authority at the Bank, said the US president’s “liberation day” tariffs have hit the reputation of American assets on the world stage.

He said the central bank is studying what would happen to Britain and the City of London if global investors turn their backs on the American currency amid Donald Trump’s trade war.

“This has created a bit of a dent, I think, in the way the US is seen both by regulators and investors. We’re asking ourselves the question, what would happen if there was a more fundamental drop in appetite for dollar-denominated assets, or US assets, or Treasuries, or some version of that,” he told the Treasury Select Committee.

“It is a difficult question to answer, but it is what we’re doing.”

The US dollar is fundamental to global financial markets, traditionally acting as the safe haven which international investors use when risks erupt in the wider economy.

But since the trade war kicked off, financiers have been ditching American assets, moving out of the dollar and away from US Government debt.

Mr Woods also said that Mr Trump’s actions have brought Britain and the EU closer together.

“We have had very good relations with our colleagues in the EU, but I can tell you that one byproduct of these events is that the warmth is increasing quite considerably, so that is actually a good thing,” he said.

“In the US we have had very strong cooperation for many years. I would expect that to continue, but… none of the three key heads of the agencies in the US have been confirmed, and until they are confirmed and we can engage properly, the jury is still a little bit out.”

Mr Woods noted that Scott Bessent, the US Treasury Secretary, appeared to cast doubt on the country’s commitment to the Basel rules which govern banking regulation in a speech last week, but told MPs he has since been reassured the US is not abandoning the internationally agreed rules.

11:56AM The euro could become the world’s safe haven currency thanks to Donald Trump’s chaotic trade war, a European Central Bank policymaker has suggested.

If the president of the world’s largest economy persists with a trade war that has roiled global markets, investors could lose confidence in the dollar, Piero Cipollone warned.

This could in turn pave the way for the euro to become the currency investors see as the safest option to pour their funds into at times of turmoil, he added.

Mr Cipollone said in a speech in Frankfurt: “If the EU upholds its status as a reliable partner that defends trade openness, investor protection, the rule of law and central bank independence, the euro has the potential to play the role of a global public good.”

It comes after Mr Trump’s unpredictable trade war unleashed market chaos after his so-called “liberation day” on April 2.

Investors took flight from US assets usually considered the safest in the world, prompting stocks to plunge, bond yields to rise and the dollar to weaken before stabilising.

The ECB’s executive board member said: “Recent moves in exchange rates, bond yields and equities, suggest that US markets have not been playing their usual role as a safe haven.”

The euro area has already “benefited” from these “safe haven flows”, he added.

Mr Piero Cipollone said: “If the long-term implications of higher tariffs materialise, notably in the form of higher inflation, slower growth and higher US debt, this could undermine confidence in the US dollar’s dominant role in international trade and finance.”

The central banker also warned that the stand off between Mr Trump and China could in a worst-case scenario lower global output by 9pc.

11:29AM Carlsberg warned “prolonged uncertainty” from tariffs could dampen consumer thirst for its drinks.

The Danish brewer reported a “solid” start to the year, maintaining its outlook despite sales dipping slightly below expectation.

Chief executive Jacob Aarup-Andersen said there had been no deterioration in consumer behaviour in April but warned this could soon change.

He said: “History tells us that prolonged uncertainty will feed into consumers’ purchasing decisions.”

The brewer has little direct exposure to Donald Trump’s tariffs as the US only accounts for a small fraction of its overall sales.

Yet Mr Aarup-Andersen said that strategies were being devised to cope with potential tariff-related impact on the price of raw materials.

Carlsberg, the world’s third largest brewer, saw global sales in the first three months of the year rise 17pc from the same period of 2024 to $3.07bn, buoyed by 2pc sales growth in China, its biggest market.

The brewer still expects between 1pc and 5pc growth in organic operating profit for the current year.

11:08AM India and the United States have made “positive progress” in their negotiations to clinch a bilateral trade agreement, the Indian government said.

The commerce ministry of the world’s most-populated country said officials from the two nations discussed the path for concluding the first tranche of a mutually beneficial trade pact by the winter of this year.

10:53AM Donald Trump’s latest climbdown on car tariffs show why “countries are in no rush to sign a deal with him”, according to Telegraph readers.

Here is a selection of views from the comments section below and you can join the debate here:

10:29AM Lufthansa said its losses worsened unexpectedly at the start of the year and warned that trade tensions with the US had heightened uncertainty.

The German airline giant reported a net loss of €885m (£752m) in the first three months of 2025, which was worse than analysts’ forecasts.

While the start of the year is typically a slow period for airlines, the figure was still worse than a €734m loss in the same period last year, when the company was affected by a wave of strikes.

The group – whose airlines include Lufthansa, Eurowings, Austrian, Swiss and Brussels Airlines – blamed factors such as rising costs at airports.

And while demand for air travel to North America remained strong in the first quarter, the group warned that Donald Trump’s tariff blitz was clouding the outlook.

“Macroeconomic uncertainties, particularly the trade tensions between the US, the EU and other regions, are making it difficult to forecast”, it warned.

Chief financial officer Till Streichert said: “We are in a period of high volatility.

“We are keeping an eye on market risks. We are well prepared to respond should these materialise.”

10:02AM The Bank of England might have been able to cut interest rates further and faster last year – to the benefit of indebted households and businesses now facing the fallout of Donald Trump’s trade war – if officials had access to new inflation data including loyalty card discounts in supermarkets.

Inflation would have been as much as 0.3 percentage points lower at points last year if the prices paid at the checkout, rather than those advertised on shop shelves, had been used, according to the Office for National Statistics (ONS).

From next year the ONS will use data from checkout scanners in supermarkets in its official measure of consumer prices.

It means lower prices for customers who sign up for loyalty schemes, likely to include Tesco Clubcard and Sainsbury’s Nectar cards, will affect the inflation data.

Last year this would have taken as much as 0.3 percentage points off the headline reading. For instance, inflation in March 2024 would have been 2.8pc with the extra data, not 3.1pc as was reported in the official numbers.

However, in the pandemic inflation would have been up to 0.1 percentage points higher, as fewer products were offered at a discount.

The Bank of England sets interest rates with the goal of keeping inflation at or around 2pc. The Monetary Policy Committee, led by Andrew Bailey, has cut rates only slowly from last summer amid fears that inflation – currently at 2.6pc and set to rise – has stayed stubbornly high.

Officials meet again next week for their first interest rate decision since Mr Trump’s ‘liberation day’ declaration of trade war.

9:47AM Shares in carmakers were mostly higher in Europe after the White House said Donald Trump was poised to reduce his tariffs against the motoring sector.

Vauxhall owner Stellantis, one of the three biggest manufacturers in the US, rose as much as 4.3pc as the President prepares to scale back his duties.

Across Europe, shares of motoring companies were up as much as 0.5pc.

However, gains across the sector were held back by Porsche, which fell as much as 7.6pc after the luxury carmaker said it expects its return on sales to fall to as low as 6.5pc, down from a previous projection of at least 10pc.

9:35AM Sir Keir Starmer is poised to send a message of defiance to Donald Trump as he signs a formal declaration committing to “free and open trade” between Britain and the European Union.

The draft UK-EU agreement promises a “new strategic partnership” between London and Brussels based on “maintaining global economic stability and our mutual commitment to free and open trade”, according to Politico.

It comes after Rachel Reeves said last week that Britain’s trading relationship with the EU was “arguably more important” than with the US.

The Chancellor later met US treasury secretary Scott Bessent in Washington to discuss UK-US relations.

Britain and the EU will hold a summit on May 19 as the two sides seek to reset post-Brexit relations in the wake of President Trump’s tariff onslaught.

The draft declaration also sees both sides pledge their “unwavering commitment to providing political, financial, economic, humanitarian, military and diplomatic” support for Kyiv and also assert their “commitment to securing a permanent ceasefire in Gaza, the release of all hostages, and [a] surge in humanitarian aid,” Politico reported.

9:16AM The boss of AstraZeneca said trade tariffs were not the best way to manage the pharmaceutical sector as drugsmakers fear a hit from US duties.

“We actually believe that a better incentive to attract investment in manufacturing and in R&D is to have a great tax policy that incentivises companies to invest in the country,” Pascal Soriot told Bloomberg TV.

The British pharmaceutical giant vowed to keep investing and growing its business in the United States ahead of President Donald Trump’s possible tariffs on the sector.

“Our company is firmly committed to investing and growing in the US,” Soriot said.

The British pharmaceutical giant announced that first quarter profit had risen by over 30pc to $2.9bn (£2.2bn).

The United States earlier in April opened the door to potential tariffs targeting pharmaceuticals, which have so far benefited from exemptions to Trump’s sweeping levies on imports from trading partners.

The US president launched a “national security” investigation into pharmaceutical imports.

The US is a key market for the pharmaceutical industry, which Soriot said he hoped will represent approximately half of AstraZeneca’s global revenue by 2030.

Shares fell as much as 5.2pc, dragging down the FTSE 100, despite the company saying today it remains on track to achieve its total target of $80bn in annual revenue by 2030.

8:49AM European shares nudged higher even as tariffs impacted the outlooks of a host of major companies.

The pan-European Stoxx 600 index was up 0.3pc, but on track for a second consecutive monthly drop, if current trend holds.

The Cac 40 in Paris was up 0.1pc and the Dax in Frankfurt was higher by 0.5pc, although the FTSE 100 dropped 0.1pc.

Porsche fell 7.4pc after the German luxury sports car maker slashed a series of forecasts for 2025 over tariff fears.

Adidas was down 0.1pc after it said tariffs had “put a stop” to its plans to raise its profit targets for this year.

Meanwhile, Deutsche Bank, Germany’s largest lender, advanced nearly 3pc after it posted a 39pc rise in first-quarter profit.

8:28AM BP profits almost halved as it faced pressure from the plunge in oil prices since Donald Trump launched his global trade war.

The FTSE 100 energy group said its preferred profit measure dropped further than expected by 49pc to $1.4bn (£1bn), while its debts swelled to $27bn (£20.1bn) amid pressure from weaker oil prices.

In February, BP revealed a new growth strategy focused on extracting more oil and gas after pressure from some investors to boost earnings.

Its boss insisted the company has “already made significant progress” with its new strategy as it pulls back from renewables to boost its finances.

However, it has been hit by declining oil prices, with Brent crude down 12pc since the start of April to around $65 a barrel. It was worth more than $82 in January, before President Trump launched his tariff campaign.

Shares fell as much as 3.3pc as BP revealed it bought back just $750m in shares in the first three months of the year, which was nearly $1bn lower than the previous quarter.

Chief executive Murray Auchincloss said: “In February, we announced a fundamental reset of our strategy – to grow the upstream, focus the downstream and invest with discipline in the transition – and we have already made significant progress.”

He added: “We continue to monitor market volatility and changes and remain focused on moving at pace.”

8:13AM HSBC has said it could suffer a “low single-digit percentage” drop in revenues and a $500m (£373m) hit from bad loans due to the impacts of Donald Trump’s tariffs.

Chief executive Georges Elhedery outlined the possible impacts of an “adverse but plausible downside scenario” resulting from the Trump administration’s trade war, as he warned the tariffs could lead to a “significant slowdown in global growth”.

Mr Elhedery said this scenario could see HSBC take a significant hit to its revenues, even as he warned that the broad impacts of the US trade war would be hard to predict.

He said HSBC could also suffer $500m worth of losses from customers failing to repay loans.

In its first quarter results, HSBC posted a 25pc drop in its pre-tax profits, mainly stemming from its decision to sell its Canadian and Argentine banking businesses last April, in line with its pivot towards Asia.

HSBC now makes most of its money in its Greater China region, which includes the People’s Republic of China alongside Hong Kong and Taiwan. The bank outlined plans to cut its wage bill by 8pc over the next two years, including by slashing jobs in its London headquarters.

However, Mr Elhedery, who took over from Noel Quinn as HSBC’s chief executive in February 2024, ruled out moving HSBC’s headquarters to Hong Kong. The bank’s largest shareholder Ping An has repeatedly called on HSBC to spin off its Asian business.

HSBC’s shares fell by up to 19pc in the immediate wake of Trump’s “liberation day”. The bank’s stock prices remains down by more than 5pc since the US president made his tariff announcements on April 2 but was up 1.9pc in early trading in London following its results.

8:06AM Stocks markets in London opened with lacklustre trading ahead of a series of economic figures today which should start to show how Donald Trump’s America is reacting to tariffs.

The FTSE 100 edged up 0.1pc to 8,423.20 while the mid-cap FTSE 250 gained 0.2pc to 19,772.45.

7:59AM Car industry bosses had told Donald Trump that tariffs on parts would “scramble the global automotive supply chain and set off a domino effect that will lead to higher auto prices for consumers”.

Trade bodies representing the likes of General Motors, Toyota, Volkswagen, Hyundai and others sent a letter to US trade representative Jamieson Greer, treasury secretary Scott Bessent and commerce secretary Howard Lutnick.

It also warned the tariffs would lead to “lower sales at dealerships and will make servicing and repairing vehicles both more expensive and less predictable”.

It said: “Most auto suppliers are not capitalised for an abrupt tariff induced disruption.

“Many are already in distress and will face production stoppages, layoffs and bankruptcy.”

It added: “It only takes the failure of one supplier to lead to a shutdown of an automaker’s production line.”

7:59AM Donald Trump will reduce the scale of his tariffs on the car industry, officials have said.

The US president will ease some of the duties on foreign parts used in American-made cars, although he will keep tariffs on cars made overseas, according to the White House.

Commerce secretary Howard Lutnick said: “President Trump is building an important partnership with both the domestic automakers and our great American workers.

“This deal is a major victory for the President’s trade policy by rewarding companies who manufacture domestically, while providing runway to manufacturers who have expressed their commitment to invest in America and expand their domestic manufacturing.”

Under the adapted levies, tariffs already paying Trump’s car tariffs will not be charged for other duties, according to the Wall Street Journal.

Carmakers said on Monday they were expecting Trump to offer relief from tariffs ahead of his trip to Michigan, which is home to the biggest three manufacturers in the US.

Trump had planned to impose tariffs of 25pc on car parts no later than May 3.

There is already a 25pc tariff on almost all imported cars, as well as on steel and aluminium.

7:51AM Thanks for joining me. Donald Trump will scale back some of his tariffs against the car industry in a boost for the industry.

The White House said the US president will ease duties on foreign car parts used in vehicles manufactured in America.

5 things to start your day

What happened overnight

Asian shares were mostly higher after U.S. stocks drifted to a quiet finish ahead of a busy week of corporate earnings and economic data that could bring more bouts of volatility.

Hong Kong’s Hang Seng gained 0.5pc to 22,070.23, while the Shanghai Composite index edged less than 0.1pc lower, to 3,286.49.

In South Korea, the Kospi jumped 0.8pc to 2,568.62. Australia’s S&P/ASX 200 also rose 0.8pc, to 8,061.90.

Taiwan’s Taiex gained 0.5pc. Tokyo’s markets were closed for a holiday.

On Monday, the S&P 500 inched up by 0.1pc, to 5,528.75, extending its winning streak to a fifth day.

The Dow Jones Industrial Average added 0.3pc to 40,227.59, and the Nasdaq Composite slipped 0.1pc to 17,366.13.