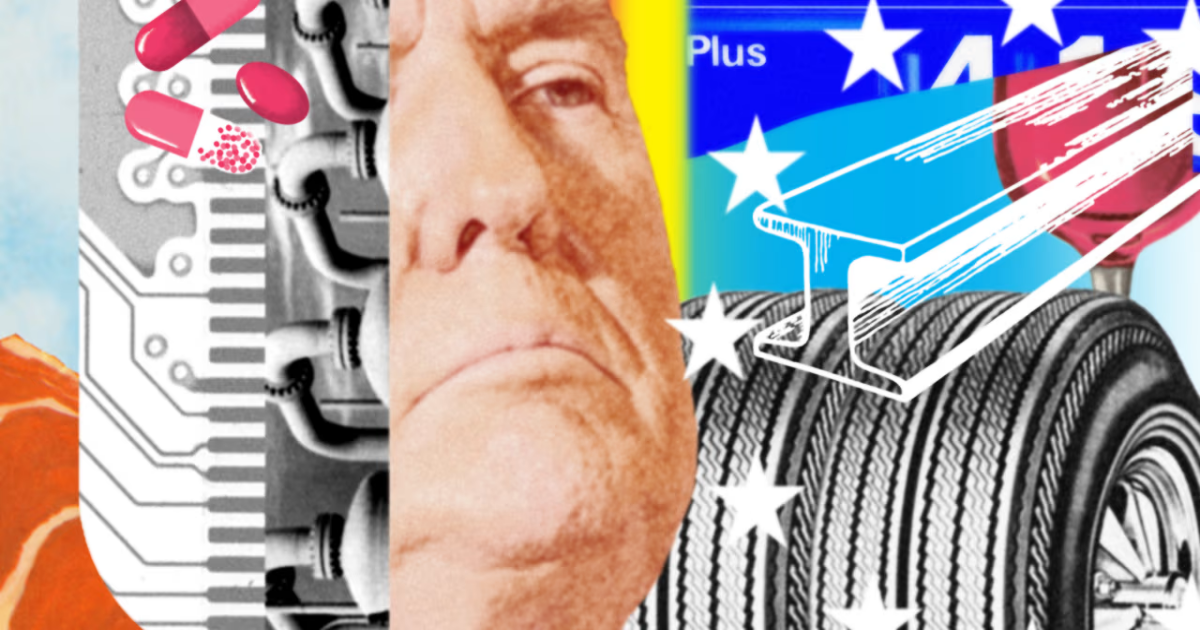

U.S. stock futures, Asian equities and the dollar rallied after President Trump said he is not planning to fire Federal Reserve Chair Jerome Powell. The president also said that 145% tariffs on China are “very high.” “It won’t be that high,” Trump said. “It will come down substantially.”

Earlier Tuesday, U.S. shares rebounded, with major indexes climbing 2.5% or more and big tech stocks regaining some ground lost a day earlier.

Traders were cheered by optimism from the White House on tariff negotiations. Treasury Secretary Scott Bessent said at an investor summit that he expects the trade war with China to de-escalate and believes a deal can be reached, according to people familiar with the matter. Bloomberg reported the news earlier.

The bounceback came despite fresh fallout from the Trump administration’s tariffs. Defense contractor RTX said it was bracing for an $850 million financial hit, while Huggies maker Kimberly-Clark said a shifting “global geopolitical landscape” was partly to blame for a lower profit outlook.

The International Monetary Fund slashed its U.S. and global economic forecasts, warning that tariffs were ushering in a new era of slower growth.

Goldman Sachs Chief Executive David Solomon said uncertainty was “too high,” holding back corporate decision-making and keeping asset prices under pressure. And the IIF, a finance industry trade group, said the U.S. faced a likely recession later this year.

Gold, meanwhile, retreated after surging early Tuesday to a new record high above $3,500 a troy ounce. The precious metal, coveted in times of uncertainty and stress, has cemented its status as the undisputed winner from this month’s tariff-fueled market turmoil.

The Dow Jones Industrial Average gained 1,017 points, or 2.7%. The Nasdaq Composite also rose 2.7%, while the S&P 500 added 2.5%.

Treasury yields edged lower. The 10-year fell to 4.389%.

The Cboe Volatility Index retreated below 31. Wall Street’s “fear gauge” had jumped Monday.

Bitcoin rose. The price of the cryptocurrency topped $91,000.

—By Caitlin McCabe and Krystal Hur

📧 Get smarter about markets with our free weekday morning and evening newsletters.