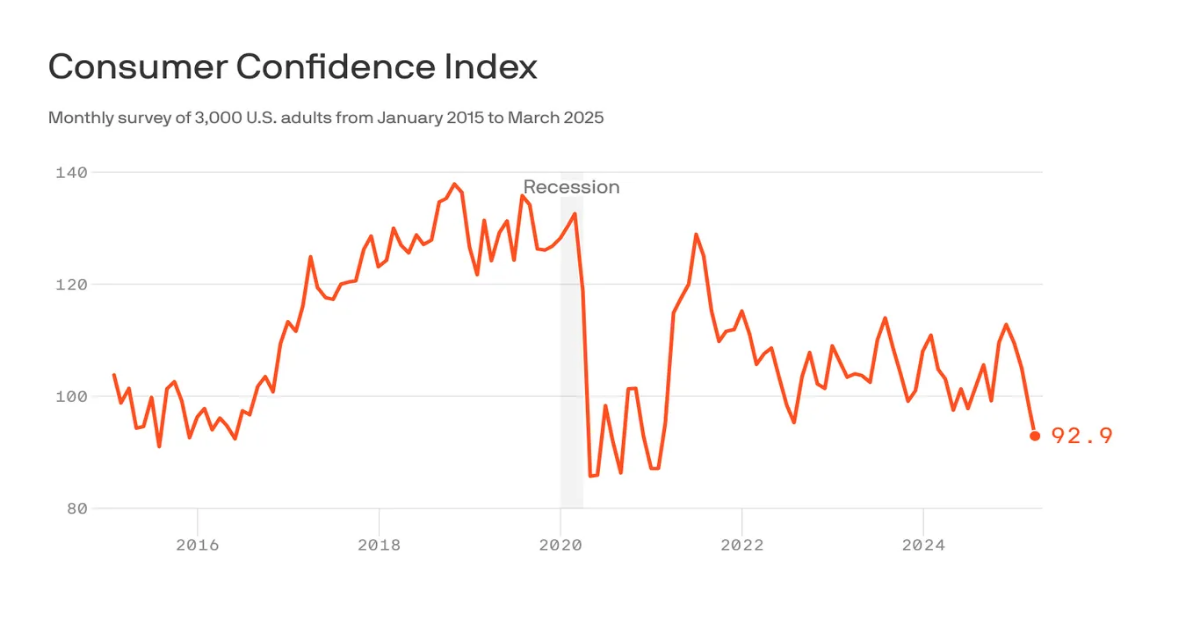

Data: The Conference Board. Chart: Axios Visuals

The economic vibes have taken a decisive turn for the worse over the last several weeks. The big question now is whether actual activity will follow.

The big picture: This week has brought yet another round of “soft” indicators that show slumping confidence in what lies ahead for the economy, amid a fast-changing policy landscape.

- It still is unclear whether it amounts to signal or noise in terms of what actually lies ahead for jobs, incomes, and growth.

Driving the news: The Conference Board’s long-running survey of consumer confidence fell for the fourth straight month in March, the business research group said Tuesday — reaching below even its level during peak inflation in 2022.

- Consumers’ near-term outlook for incomes, business, and labor market conditions fell to the lowest in 12 years, and far below the threshold that usually signals a looming recession.

- The deterioration was sharpest among older Americans.

- Separately, an index that measures small business owners’ confidence, published by the U.S. Chamber of Commerce Wednesday, fell in the first quarter to about its level of a year ago, erasing a post-election surge.

Of note: Even before the disruptions of the Trump administration’s trade wars and government spending cuts, there were signs many households were facing challenging financial times.

- In the fourth quarter, the share of credit card debt more than 90 days delinquent was at a 13-year high, per New York Fed data.

Yes, but: Confidence surveys have been a flawed predictor of actual economic activity in the last few years. For much of the Biden administration, public opinion about the economy was steeply negative — even as consumers kept spending and business kept hiring.

- “There have been plenty of times where people are saying very downbeat things about the economy and then going out and buying a new car,” Federal Reserve chair Jerome Powell said last week.

- “But we don’t know that that will be the case here.”