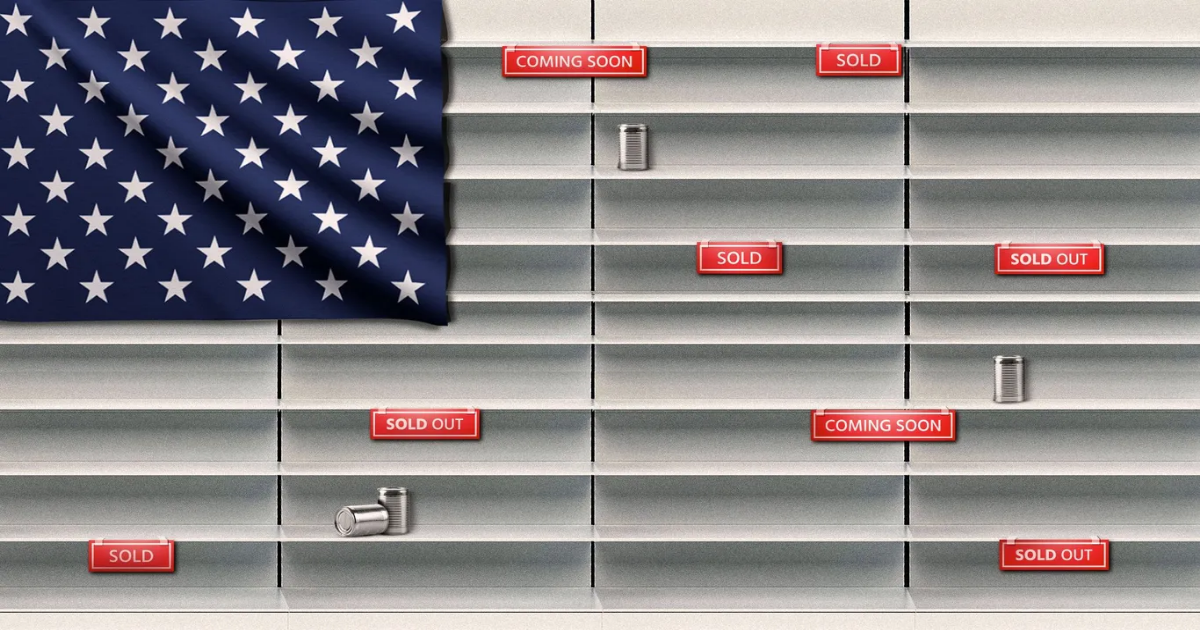

Illustration: Aïda Amer/Axios

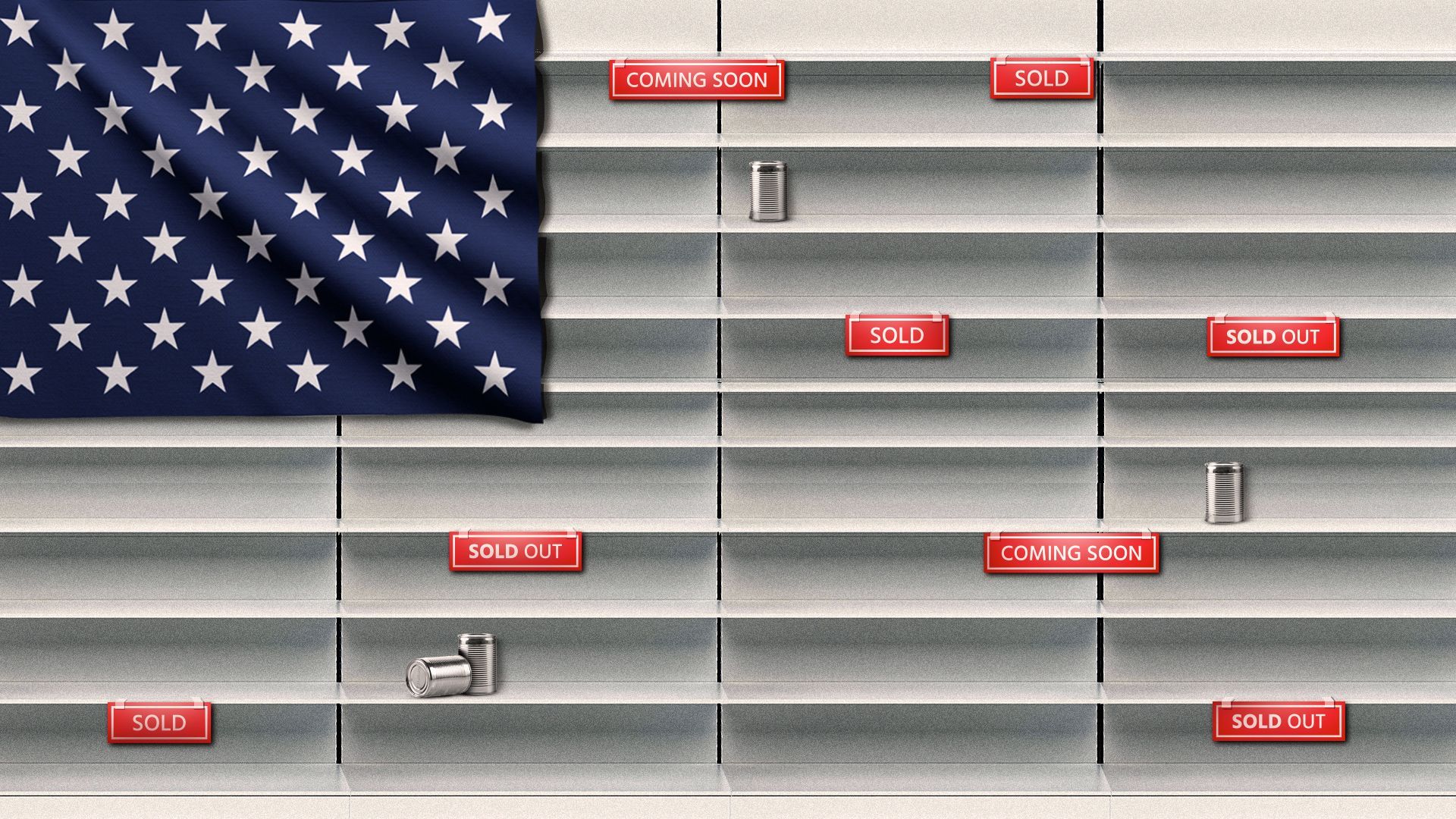

Illustration: Aïda Amer/Axios

President Trump got a scare from CEOs and markets on Monday. On Tuesday, he blunted some of his sharpest threats — signaling a softer stance on China and retreating from fiery rhetoric targeting the Fed.

Why it matters: The president is resolute in his goal of reshaping the economy. But he’s sensitive to the movement of the markets and the pleas of powerful corporate leaders and investors who fear the worst from his sweeping efforts.

Zoom in: Monday was a tough day for Trump’s goal of reshaping the global economy.

- The CEOs of three of the nation’s biggest retailers — Walmart, Target and Home Depot — privately warned him that his tariff and trade policy could disrupt supply chains, raise prices and empty shelves, according to sources familiar with the meeting.

- “The big box CEOs flat out told him [Trump] the prices aren’t going up, they’re steady right now, but they will go up. And this wasn’t about food. But he was told that shelves will be empty,” an administration official familiar with the meeting told Axios.

- Another official briefed on the meeting said the CEOs told Trump disruptions could become noticeable in two weeks.

- While that was happening, financial markets were slumping — stocks, bonds, the dollar — as investors panicked about Trump’s latest threats to oust Fed chair Jerome Powell and step on the central bank’s independence.

Then on Tuesday, he turned the dial down.

- His Treasury secretary, and then his press secretary, and then Trump himself all indicated that trade talks with China were imminent, starting on a good foot, and would result in a deal with much lower tariffs than the current 145%.

- Trump then told reporters in the Oval Office that he had “no intention” of firing Powell, even though his top economic adviser said last week the White House was studying the details of doing exactly that.

- Markets, having gotten what they wanted, promptly rallied hard. Stocks soared and the dollar surged.

The intrigue: White House officials bristle at the notion of softness from Trump. One senior official said the president was just showing he’s ready to make a deal and that he’s “optimistic we can move forward.”

- “This is what Donald Trump does. He leads with leverage,” the official said. “He gets people to the table. China has expressed interest in negotiation. And the president has made clear that if they play ball, he’ll play ball, too.”

Between the lines: Trump’s shift in tone comes at the same time as a shift in Trump’s orbit.

- Treasury Secretary Scott Bessent has been exerting more influence in recent weeks, reportedly getting in Trump’s ear — to the point of rushing the Oval Office when other advisers aren’t around — to get him to ease off for the sake of markets.

The big picture: For the first time since he entered political life, polls show most voters disapprove of Trump’s handling of the economy.

- Inflation — which he claims is nonexistent — is still a little hot, growth is slowing, and manufacturers are losing confidence.

- Recession isn’t inevitable, but it looks a lot more likely now than it did even a couple of months ago.

- Around the world, the “sell America” trade is taking hold, as investors start to realize decades of orthodoxy about U.S. assets as safe havens may no longer be the case.